Getting preapproved for a mortgage is an essential part of the home-buying process. While it’s possible to wait before securing your financing, there are major benefits to getting preapproval early.

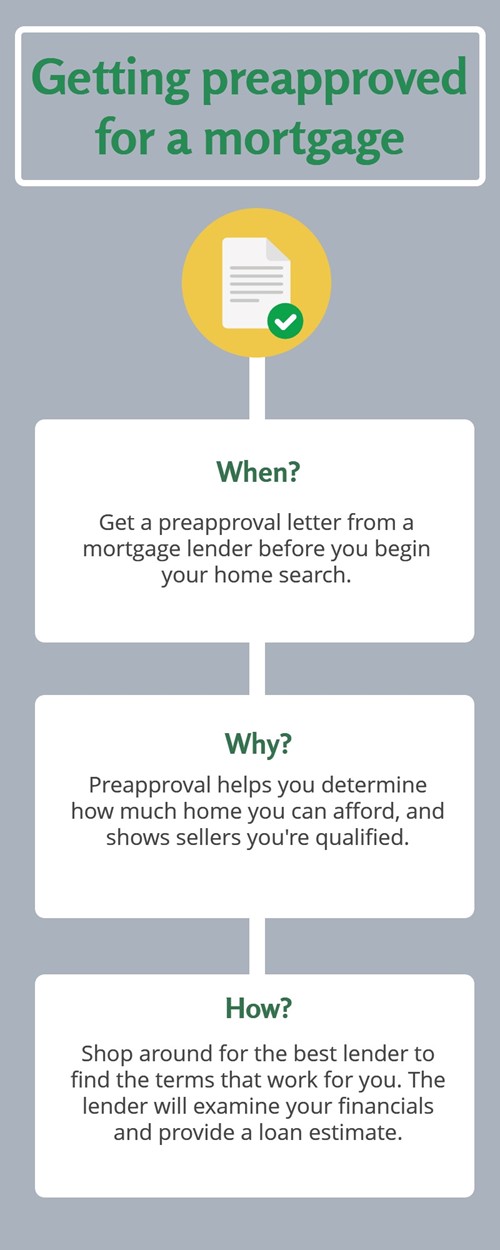

For more information about preapproval, here are the basics to consider:

It’s recommended that would-be homebuyers obtain a preapproval letter from a mortgage lender as soon as possible in their buying process. The earlier you take care of this important step, the earlier you’ll know exactly how much money you can afford to spend on a home. This can help you narrow down your home search.

In addition to helping your home search, getting mortgage preapproval also shows sellers you are a qualified buyer. Preapproval requires a careful examination of your financial situation, including factors like debt-to-income ratio and liquid assets.

Going through the process confirms your eligibility for a mortgage and communicates to sellers that you’re less likely to back out of a sale.

Compare mortgage lenders to find the best fit for your needs. You can request a loan estimate and mortgage preapproval letter from a lender after providing essential documentation like investment account statements, bank statements, pay stubs and credit report.

If you intend to buy a home, it’s a good idea to get preapproved for a mortgage sooner rather than later. The more prepared you are with your finances, the more effective your home search will be.

Hi I am Roseann Dugan, I have over 25 years experience working with both buyers and

sellers. I have been licensed in four different states and am very familiar

with the relocation process. I have worked extensively with relocating families

and I hold the designation as a Relocation Specialist. I have also worked

with Land development and New Construction. I am also a Senior Real Estate

Specialist (SRES) and an Accredited Buyer's Representative (ABR).

I am a Full Time Agent who is dedicated to making the Home

Buying or Selling Experience a positive one